The smartest capital in sports isn't chasing what's trending on Twitter. It's quietly building positions in an asset class that most institutional investors still don't fully understand.

While everyone debates whether the NFL's new private equity rules matter, sophisticated family offices are already three moves ahead—identifying the operational arbitrage plays that'll define the next decade of sports wealth creation.

That's where we come in.

1 + 1 = 3 (Who We Are & Why We Exist)

This communication is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy any securities. Any such offer will be made only pursuant to official offering documents and only to accredited investors. Any references to cash flow, tax benefits, or equity growth are illustrative and not guarantees of future performance.

1 + 1 = 3 (Who We Are & Why We Exist)

Momentous Sports operates at the intersection of professional sports and institutional real estate—the only investment platform designed specifically for family offices and high net worth individuals seeking sophisticated exposure to sports as an asset class.

Our thesis is simple but overlooked: The future belongs to investors who understand that sports teams are really entertainment companies anchored to massive real estate opportunities.

While others chase franchise valuations, we focus on the underlying business models that actually generate sustainable cash flow. That's why our investment strategy combines meaningful minority positions in professional teams with the development of sports-anchored mixed-use districts that create value 365 days a year.

It's our 1 + 1 = 3 approach: Team operations plus real estate development equals returns that exceed the sum of their parts.

The result? Targeted diversified returns ranging from 1.5x-6x for our real estate components to 2x-10x for team operations, with hold periods of 3 -10 years that align perfectly with family office and long-term capital investment horizons.

We’ve already assembled an exceptional group of founding partners and cornerstone investors who share this vision—including some names that surprised the industry when announced. Their involvement reinforces both the strength of our thesis and the momentum behind Momentous Sports.

What Others Miss (And Why It Matters)

The sports private equity landscape just hit an inflection point that most people are analyzing completely wrong.

Everyone's talking about the NFL finally allowing institutional investment. What they're missing: this wasn't about giving PE funds access to trophy assets. It was about solving a succession crisis that's quietly affecting dozens of family-owned franchises across all major leagues.

Here's the real story: Average NFL franchise values now exceed $6 billion. Estate tax implications are forcing succession issues that traditional family structures can't handle. Meanwhile, the operational complexity of modern sports franchises—from media rights optimization to sports betting integration—requires institutional-level expertise that most family ownership groups simply don't possess.

The opportunity isn't only buying teams. It's buying the infrastructure that supports them.

The Data Categories That Drive Decision-Making

Our research platform tracks the metrics that actually correlate with investment performance, not the vanity numbers that make headlines:

Market Intelligence

Real estate development opportunities around venue lease expirations (no less than 47 major venues through 2030, with many more in the minor leagues

Media rights trajectory analysis beyond the obvious renewal cycles

Sports betting integration revenue potential by franchise and market

International expansion opportunities in undervalued leagues

Operational Analytics

Mixed-use development performance benchmarking (much higher yields vs standalone venues)

Tax optimization strategies specific to sports + real estate combinations

Revenue diversification metrics that predict franchise stability

Technology adoption patterns that create competitive advantages

Investment Flow Tracking

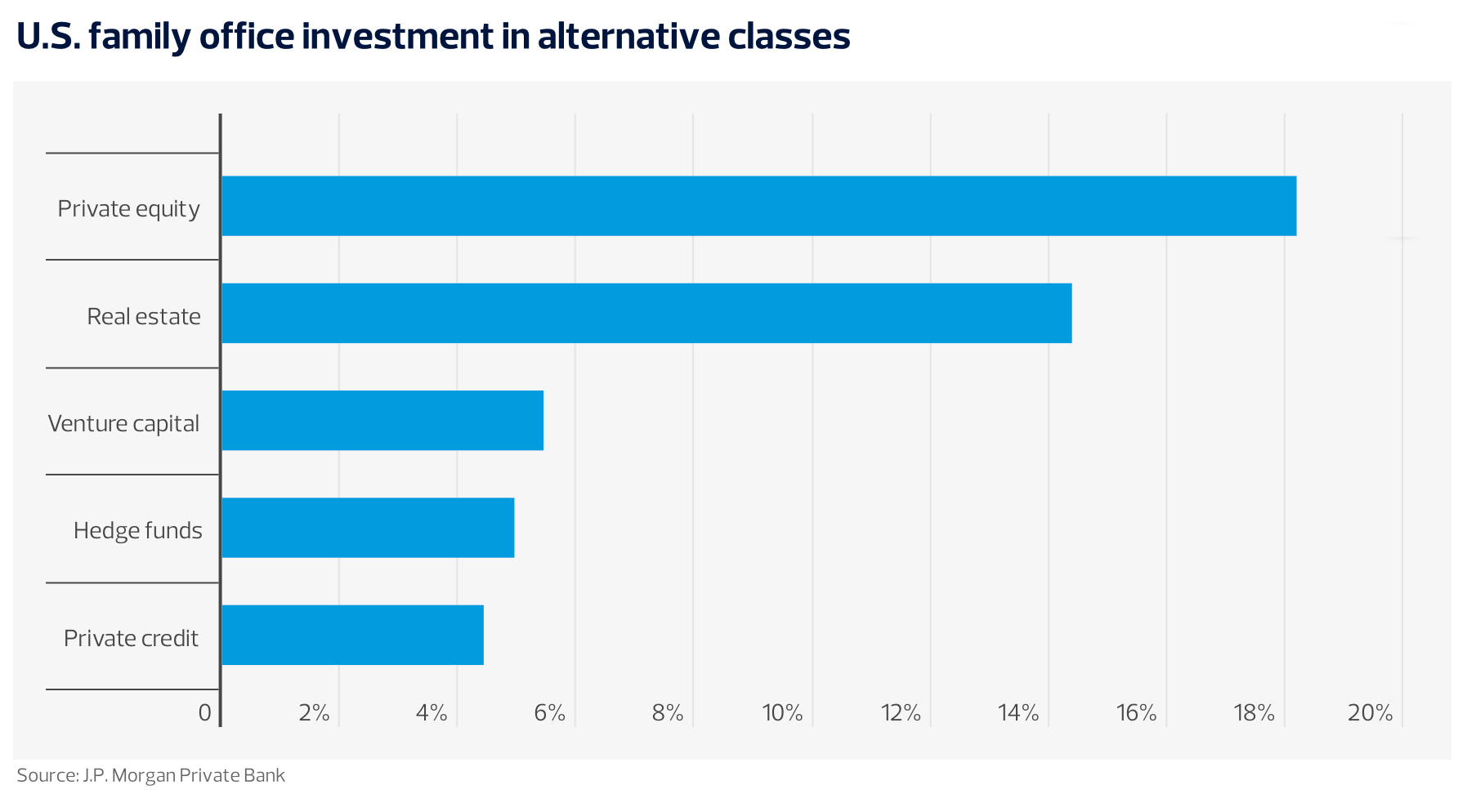

Family office allocation trends and successful co-investment opportunities

Private equity fund performance by strategy type and hold period

Exit market dynamics and optimal timing indicators

Regulatory changes across international sports markets

Coming Content You Won't Find Elsewhere

Every issue of The Whiteboard delivers insights that matter to sophisticated investors making real allocation decisions:

Market Reframes: We don't regurgitate press releases. We identify the counterintuitive opportunities that everyone else misses—like why the most valuable sports real estate isn't in New York or Los Angeles, but in secondary markets where teams own their development rights.

Operational Intelligence: Deep dives into the business models that actually work. Why some teams generate consistent cash flow while others struggle despite higher valuations. How venue control creates lasting competitive advantages. Which technology investments pay dividends versus which ones are expensive distractions.

Investment Case Studies: Real analysis of successful sports investments, with actual numbers and lessons learned. What worked, what didn't, and why most coverage completely misses the point about sports as an institutional asset class.

Deal Flow Context: When opportunities emerge in our network, you'll understand not just the terms, but the underlying market dynamics that make them attractive (or problematic).

The Atlanta Battery Blueprint

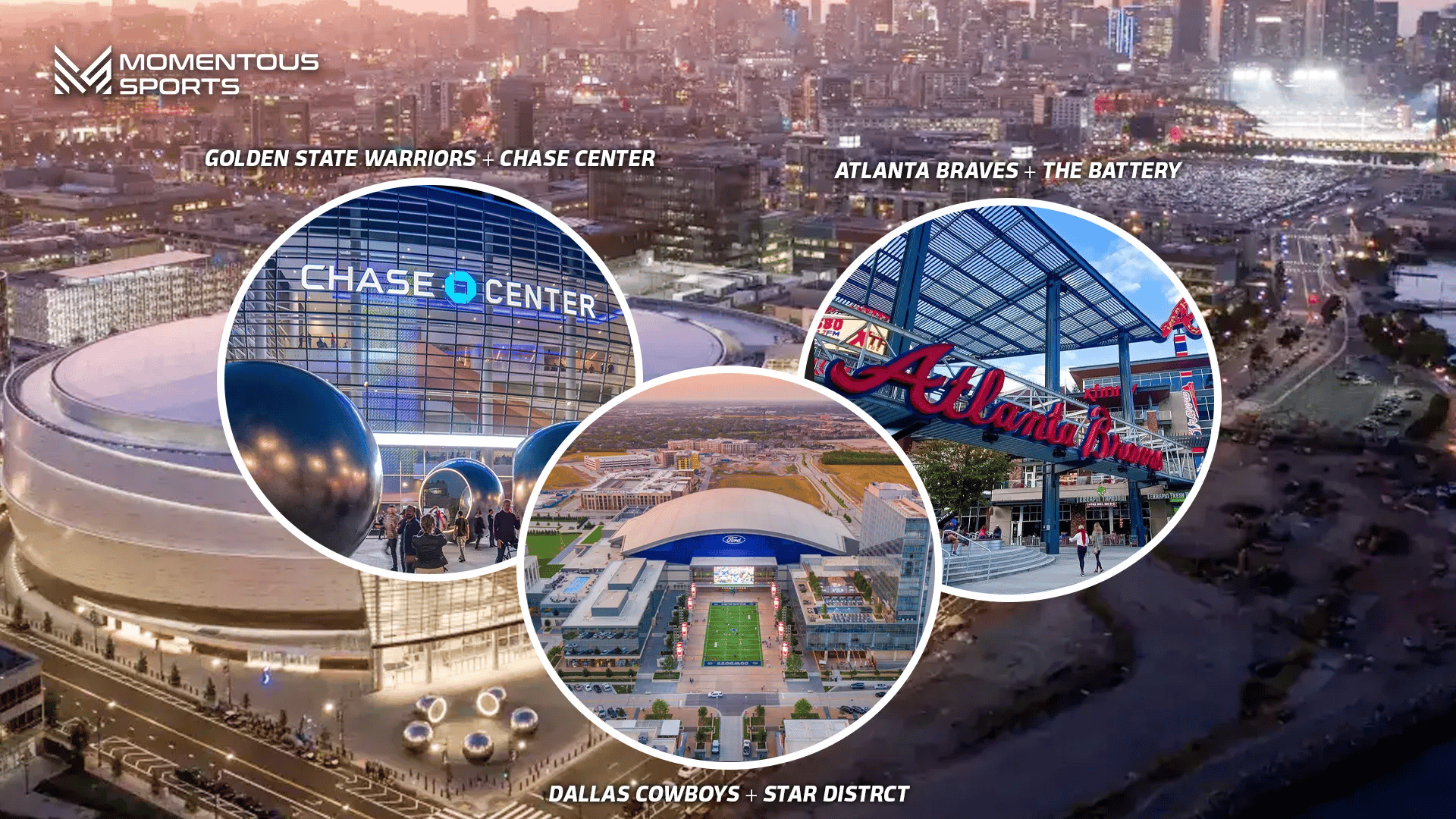

Want to understand our investment philosophy? Look no further than what the Atlanta Braves built.

Since opening Truist Park and The Battery in 2017, the Braves have generated $348 million in mixed-use revenue—completely exempt from MLB revenue sharing rules. That's pure, high-margin cash flow from retail, dining, office, residential, and hotel components that operate year-round.

The numbers tell the story:

9+ million annual visitors (far exceeding baseball attendance)

2.25 million square feet of diversified real estate

49% YOY growth in mixed-use revenue Q2 2025 vs Q2 2024

But here's what most people miss: The Battery wasn't just a real estate development. It was a systematic approach to capturing value from the broader economic activity that sports franchises create.

That's our blueprint. Own meaningful positions in teams that control their real estate destiny. Develop mixed-use assets that generate stable cash flow regardless of on-field performance. Scale the model across markets where the opportunity exists.

Why Family Offices (And Why Now)

Family offices bring a distinct perspective to sports investing: the recognition that the most compelling alternative opportunities often demand discipline, operational expertise, and a long-term view that extends beyond quarterly earnings.

Sports investments check every box:

Long-Term Appreciation – Aligned with private investment cycles and rising valuations

Resilience & Diversification – Durable cash flows from sports + real estate across cycles

Tax Efficiency – Structures like depreciation and opportunity zones that enhance net returns

Legacy Creation – Compounding value that extends beyond financial performance

The regulatory environment has finally caught up. With all major North American leagues now permitting private equity investment, the infrastructure exists for sophisticated investors to access this asset class at scale.

More importantly: The succession issues affecting current sports ownership create opportunities for capital positioned to capture rising valuations while navigating both the business complexities and family dynamics involved.

Your Competitive Advantage Starts Here

This newsletter exists because the sports investment landscape desperately needs institutional-quality intelligence designed for sophisticated decision-makers.

We don't write for sports fans or casual investors. We write for family office principals and long-term investors who allocate meaningful capital based on rigorous analysis and proven operational strategies.

Every issue delivers:

Unique insights you won't find in mainstream sports business coverage

Specific examples with real numbers, not vague industry trends

Analysis of actual opportunities within our investment focus areas

Intelligence that helps you think three moves ahead of the market

The sports business has evolved far beyond what most people understand. The opportunities ahead belong to investors who recognize that sports franchises are really diversified entertainment and real estate platforms with significant competitive advantages.

Welcome to your edge,

Momentous Sports

Schedule a Conversation

Ready to explore how sports investments might fit within your family's broader strategy? We're having detailed conversations with qualified family offices about the opportunities we're seeing and how our platform might align with your objectives.

This communication is for informational purposes only and does not constitute an offer to sell or solicitation of an offer to buy any securities. Any such offer will be made only pursuant to official offering documents and only to accredited investors. Any references to cash flow, tax benefits, or equity growth are illustrative and not guarantees of future performance.