Context for This Week’s Analysis

A Note to Our Readers: We acknowledge that many of you are already familiar with the dynamics of soccer (or fútbol, as it's known globally), both as a sport and as a business. However, there's a growing investor base that is deepening their familiarity with the sport and is still learning why soccer is trending and highly active in relation to investing. This piece is designed to bridge that gap by providing both the macro context and the micro examples that demonstrate why sophisticated capital is moving into this space now.

This publication discusses market trends and industry dynamics. It does not describe any specific securities offering or investment terms.

Given the depth of this topic, today's newsletter is longer than usual. View the PDF version to digest the investment frameworks and case studies at your own pace.

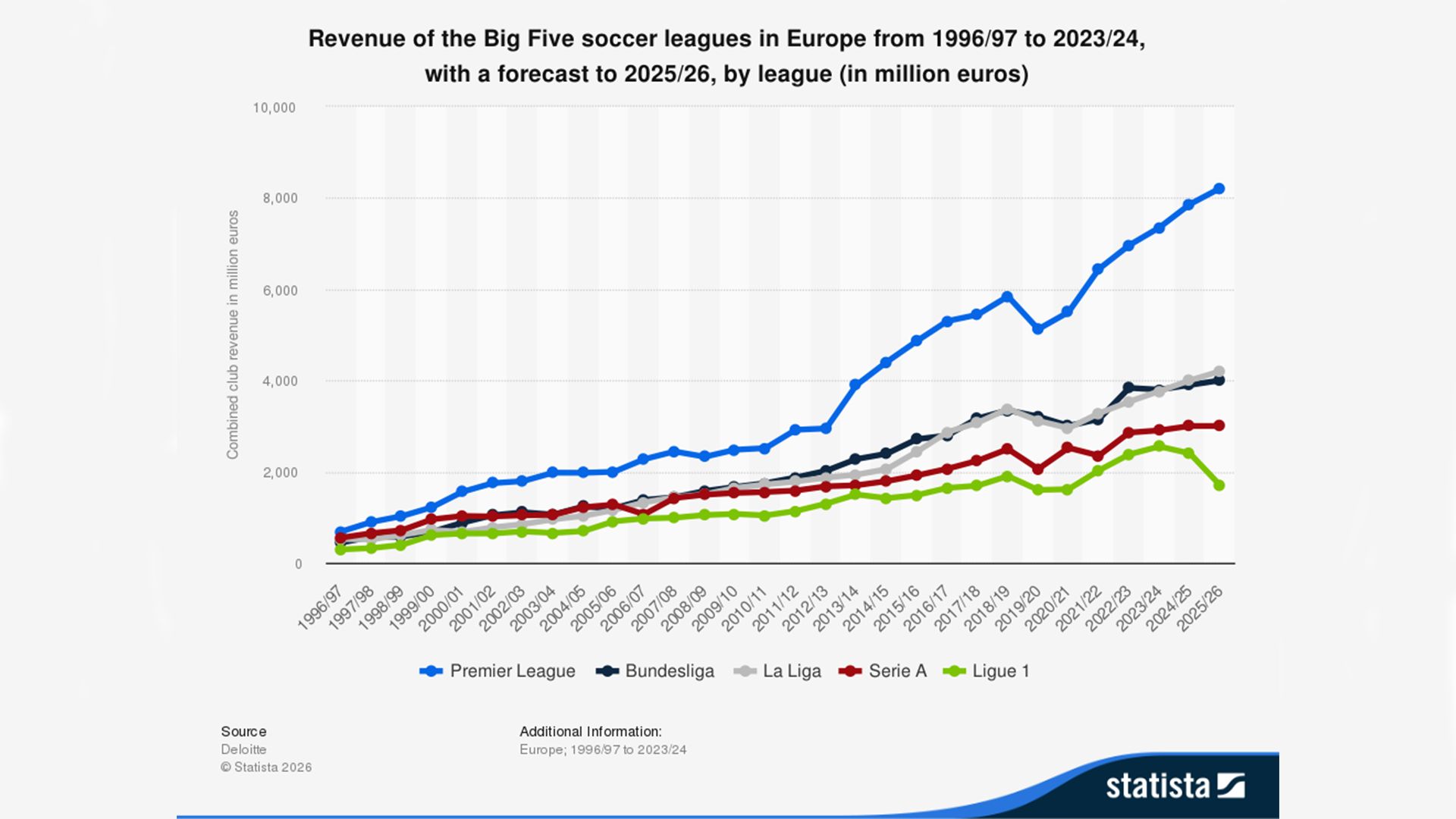

Soccer isn't just growing in the United States. It's undergoing a fundamental re-rating as a vertical within the sports asset class, driven by forces that separate it from every other sport: global liquidity, demographic tailwinds, venue-driven real estate economics, and competitive structures that reward operational sophistication.

This convergence explains why institutional investors are deploying capital across the soccer ecosystem at an accelerating pace. These aren't cultural bets. They're calculated plays on scarcity, cash flow predictability, and favorable long-term trends that position soccer uniquely among professional sports investments.

Global Context: Soccer's Unmatched Scale Creates Investment Liquidity

Soccer is the only truly global sport, and that scale creates investment characteristics unavailable in any other vertical within sports.

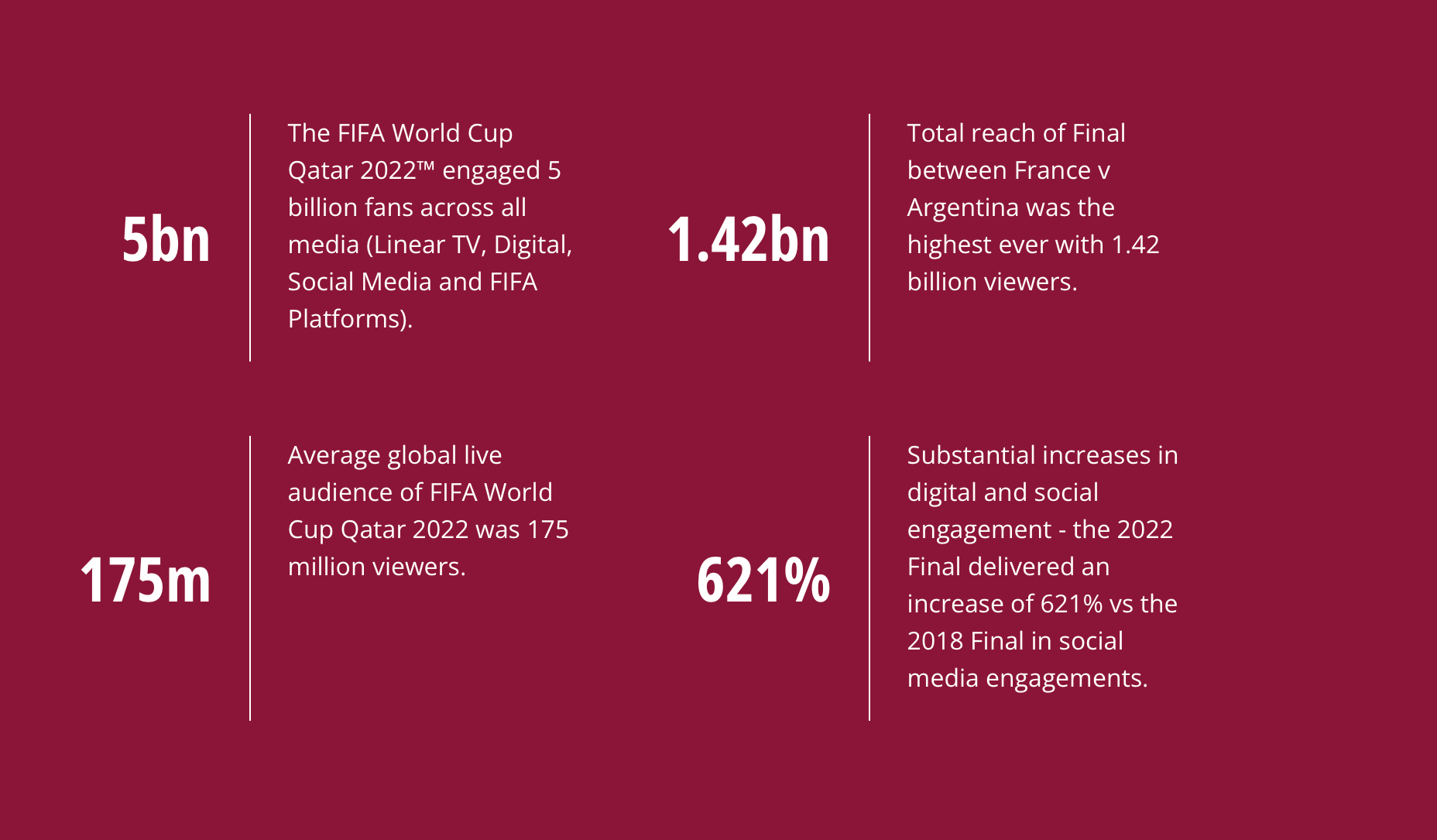

Metric | Scale | Investment Implication |

2022 FIFA World Cup Final Viewership | 1.42 billion viewers | Unmatched global audience reach |

Total World Cup Engagement | ~5 billion people across platforms | Deep, liquid markets for talent and rights |

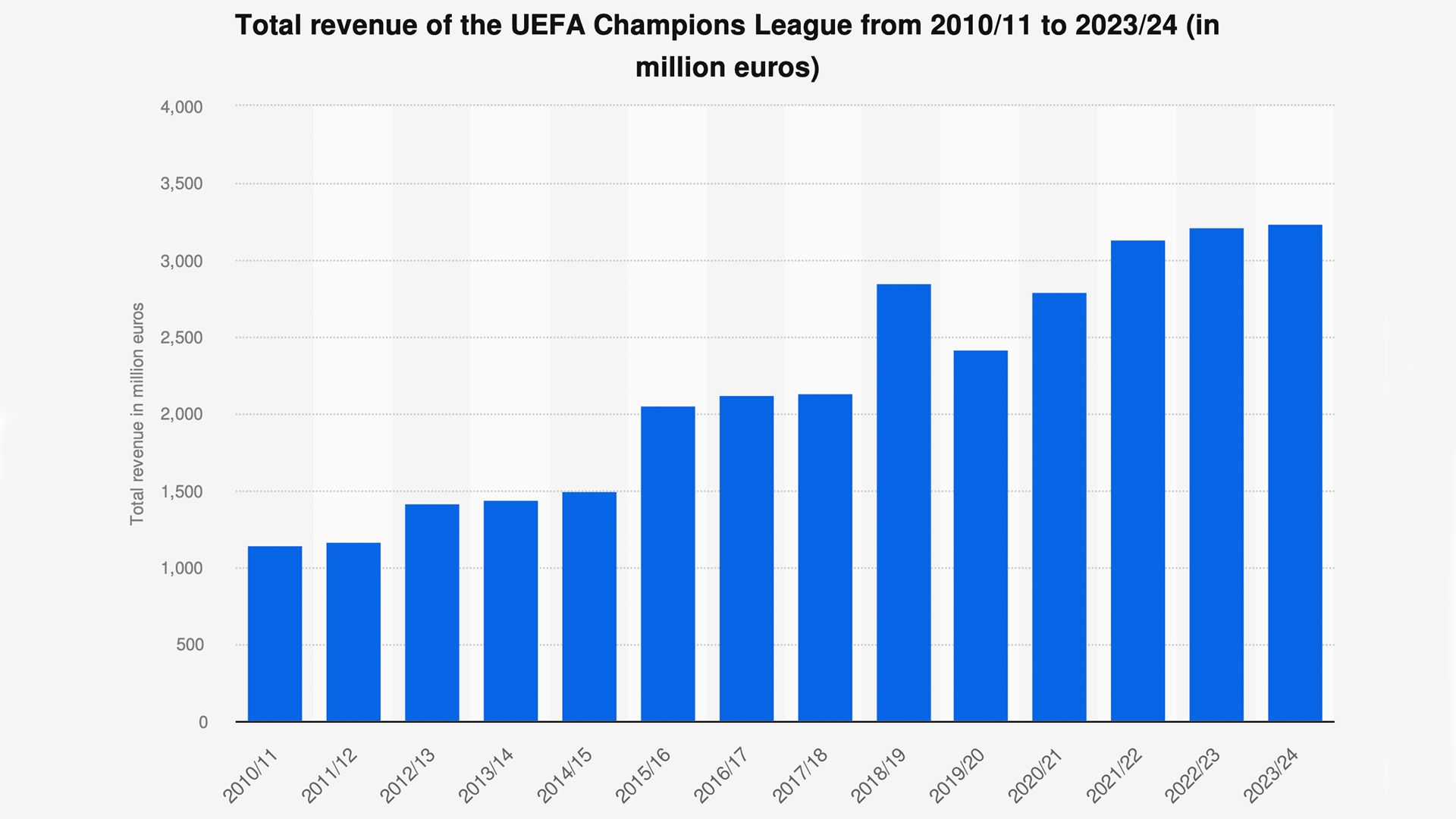

UEFA Champions League Revenue (2022/23) | €3.2 billion | Proven commercial infrastructure |

EPL Domestic Broadcasting Deal (2025-2029) | £6.7 billion | Predictable, long-term cash flows |

What This Means for Investors: Soccer offers deep, liquid markets for talent transfers, broadcasting rights, and franchise valuations that no other sport can match.

A player developed in South America can be sold to Europe for eight figures. A club in England's Championship can generate more revenue than top division teams in North American leagues.

European football's promotion and relegation system drives continuous competitive intensity, fan engagement, and media interest. This creates mechanisms for value creation that sophisticated investors can access through secondary markets, minority stakes, and control buyouts.

Recent Transactions Underscore the Valuation Dynamics

Chelsea FC sold for £4.25 billion ($5.2 billion) in 2022, one of the highest valuations ever recorded for a sports franchise globally.

Liverpool FC is currently valued at $5.4 billion, representing an 11x return from its $478 million purchase price in 2010 under Fenway Sports Group. This return was driven by strategic investment in facilities, analytics, and commercial infrastructure, not league-guaranteed media contracts.

European Club Minority Stakes: Clubs across Europe's top five leagues routinely trade minority stakes to institutional investors like RedBird Capital, CVC Capital Partners, and Arctos Partners, creating liquidity mechanisms unavailable in closed North American league structures.

Key Insight: Soccer offers global diversification and exit optionality that no other sport provides.

Nonetheless, the historical transaction examples cited are not representative of any future investment outcomes and are provided solely for market context.

Why Soccer Is Thriving in the United States: Macro Tailwinds and Historical Precedent

American soccer is experiencing its fastest growth period in history, driven by demographic momentum that compounds annually rather than cyclically. But this isn't the first time a singular event has catalyzed a generational shift in the sport's trajectory in the United States.

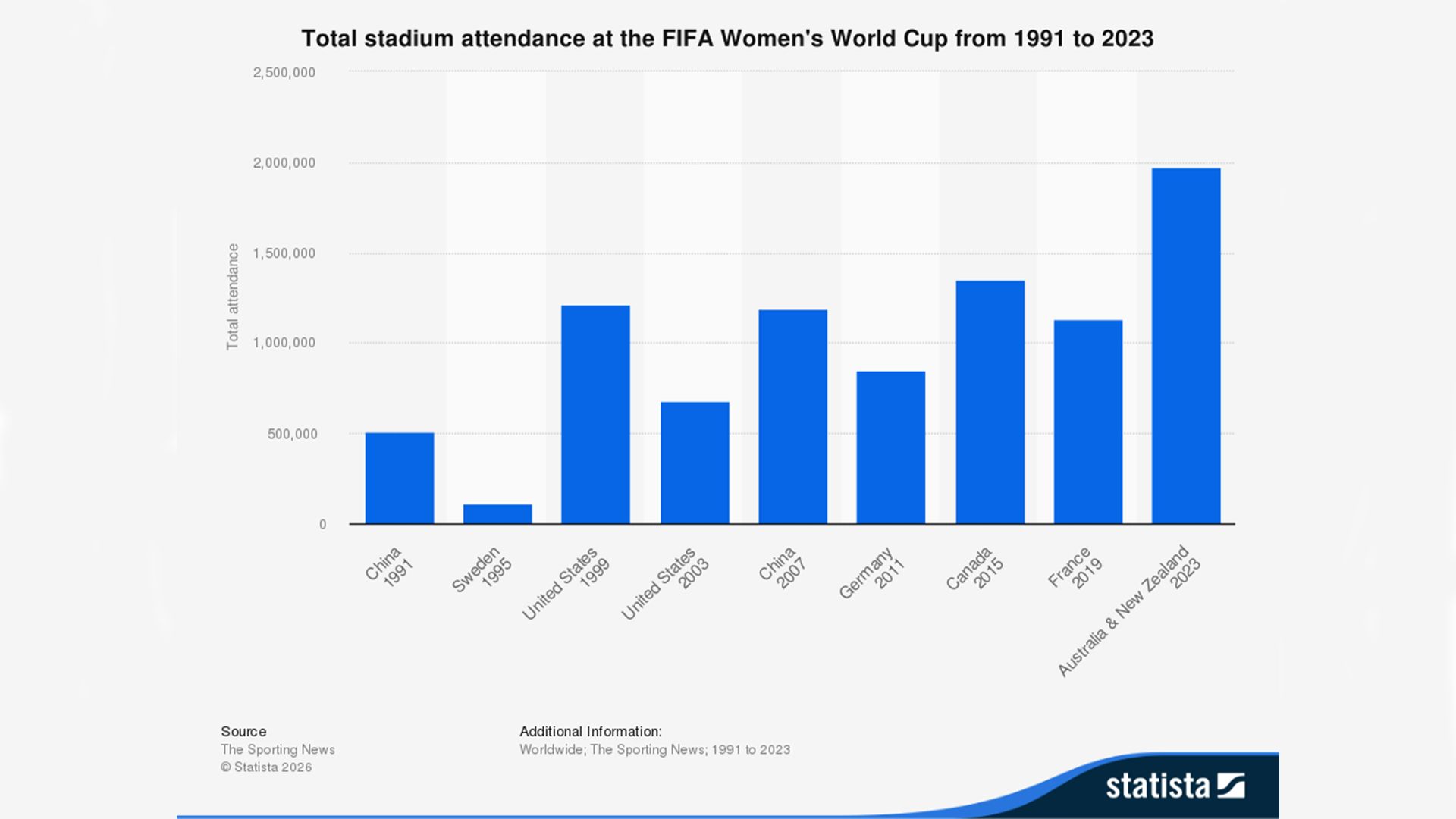

The 1999 Women's World Cup: A Case Study in Catalytic Events

The 1999 FIFA Women's World Cup, held in the United States, drew over 90,000 fans to the final at the Rose Bowl and became the most-watched soccer match in U.S. television history at the time. The tournament didn't just capture a moment. It fundamentally altered the sport's perception and participation in America.

What Happened After 1999:

Youth soccer participation surged, particularly among girls, with registration numbers climbing steadily through the 2000s

Major League Soccer, which had launched just three years earlier in 1996, gained legitimacy and momentum

Corporate sponsorship of soccer increased as brands recognized the demographic appeal of the sport's growing fanbase

The event laid the foundation for soccer to transition from niche to mainstream over the following two decades

2026 FIFA World Cup: The Next Inflection Point

The 2026 FIFA World Cup, co-hosted across the United States, Mexico, and Canada, will be the most attended World Cup ever and the first to feature 48 teams, expanding the tournament's scale and global reach. This isn't a one-time event. It's a catalyst accelerating trends already in motion.

Expected Impact and Current Momentum:

US Youth Soccer: Nearly 2.5 million players registered annually, making it one of the most participated youth sports in the country

Demographic Profile: Young, diverse, and digitally native, exactly the audience brands and broadcasters covet

Infrastructure Investment: Stadiums, training facilities, and youth development systems are being upgraded nationwide in preparation

Media and Sponsorship: Brands are positioning for the tournament, driving pre-event sponsorship and media deals to record levels

Cultural Shift: Soccer is no longer niche. It's mainstream entertainment with multigenerational appeal

If the 1999 Women's World Cup created a foundation, the 2026 Men's World Cup has the scale, infrastructure, and commercial backing to cement soccer as a top-tier sport in the U.S. for decades.

MLS Expansion Reflects Institutional Confidence

Major League Soccer has added 10 expansion franchises since 2017, with entry fees rising from $150 million to over $500 million for the most recent awards.

In 2023, Apple launched a $2.5 billion, 10-year worldwide deal with MLS, likely just the beginning of escalating media valuations, representing the league's first globally accessible broadcast platform and signaling that soccer in the U.S. is no longer a niche product but a scalable media asset.

But an attractive growth story is happening even outside the MLS. It's happening in the tiers below, where the United Soccer League is building something structurally different.

The USL: A Case Study in Strategic Positioning

Sports Illustrated, Detroit City FC

The United Soccer League operates the most sophisticated multi-tier professional soccer structure in North America. With over 120 professional and pre-professional clubs across its Championship, League One, and League Two divisions, the USL is building a promotion and relegation system designed to achieve U.S. Soccer Tier 1 status for its top division.

This isn't minor league baseball. It's a professionalized, geographically diversified league system operating in markets where soccer is, in many cases, the only professional sports option.

USL Competitive Advantage | Details |

Geographic Positioning | Markets like Louisville, Detroit, Phoenix, and Albuquerque have limited competition for live entertainment dollars |

Stadium Economics | Soccer-specific venues at $50M to $100M vs. $1B+ for major league facilities |

Operational Model | Year-round entertainment platforms, not seasonal facilities |

Regulatory Pathway | Building toward U.S. Soccer Tier 1 status with promotion/relegation |

Institutional Validation | Investment from BellTower Partners signals league stability and growth trajectory |

Belltower Capital's $100M Investment: A Signal of League Level Stability

In a landmark move, Belltower Capital committed $100 million in institutional investment directly into the USL at the league level. This capital injection represents more than just funding. It's a vote of confidence in the league's structural model, governance, and long-term growth strategy.

What This Investment Signals:

Institutional Validation: Sophisticated capital views the USL as a durable, scalable platform

League Stability: The investment supports league infrastructure, media capabilities, and operational professionalization

Growth Trajectory: Capital will fund expansion, commercial partnerships, and technology investments that enhance the league's competitive positioning

Owner Support: By strengthening the league, the investment creates a rising tide that lifts all clubs, enhancing franchise values and operational support systems

This is not speculative capital. It's a strategic investment in a league structure designed to support sustainable, long-term growth under the leadership of USL CEO Alec Papadakis.

What Makes This Institutionally Relevant?

Three structural advantages position USL clubs as disciplined, scalable investments, with stadium ownership and mixed-use real estate development serving as the core thesis at both the club and league level.

1. Real Estate and Stadium Development: The Core of the USL Thesis

Soccer-specific stadiums are becoming year-round entertainment assets, not seasonal facilities. At the USL level, stadium ownership and participation in mixed-use development are central to the investment model and serve as a critical hedge against the competitive dynamics inherent in promotion and relegation.

Why Real Estate Anchors the Investment Thesis:

For sophisticated investors, the combination of stadium ownership and adjacent real estate development provides downside protection and upside optionality that transcends on-field performance.

Even in systems with promotion and relegation, where competitive results can drive revenue volatility, real estate assets provide stable, diversified cash flows that insulate investors from performance-based risk.

This is why the USL emphasizes stadium and mixed-use development as a foundational element of its league strategy. By encouraging clubs to own their venues and develop surrounding real estate, the league creates an operating model where:

Clubs have the potential to generate 365-day revenue streams from non-soccer events, hospitality, retail, and commercial partnerships

Franchise values are anchored in hard assets, not just media contracts or ticket sales

Investors can underwrite opportunities based on real estate fundamentals, reducing reliance on speculative sports economics

2. Operational Sophistication and AI-Enabled Margins

Mid-tier soccer clubs are deploying advanced analytics for player identification, injury prevention, pricing optimization, and fan engagement at a pace that outstrips legacy franchises in more established leagues.

How AI Creates Competitive Advantage:

Talent Scouting: Championship clubs scout globally using predictive models and data platforms like Opta, once available only to top-tier European clubs

Dynamic Pricing: Real-time ticket pricing optimization based on demand signals and fan behavior using platforms like SeatGeek and Ticketmaster

Fan Lifetime Value: Predictive modeling for engagement, retention, and revenue per supporter through CRM systems

Injury Prevention: Biometric data and workload management using wearables like Catapult and STATSports reduce player downtime

OKC for Soccer: USL Stadium Development Case Study

OKC Energy FC, competing in the USL Championship since 2014, represents a long-term approach to building soccer infrastructure in an emerging market. The club secured an investment from Russell Westbrook in late 2024, the former Oklahoma City Thunder star, to anchor a broader downtown development strategy.

Model: Stadium development integrated into a 40-acre downtown entertainment district featuring dining, retail, and community spaces, with Westbrook participating in the design and development of surrounding areas

MAPS 4 Connection: The $121 million stadium project within Oklahoma City's MAPS 4 initiative, a capital improvement program approved by voters in 2019 that includes funding for sports and wellness facilities

Ownership and Stability: Westbrook's investment, combined with ownership led by Christian Kanady, provides financial backing and high-profile support that enhances the club's long-term viability

Investor Thesis: The combination of purpose-built stadium infrastructure and 40-acre mixed-use development creates year-round revenue opportunities that extend beyond matchday economics, demonstrating how celebrity investment paired with real estate integration can transform second-tier soccer clubs into anchors for urban revitalization

This model is replicable, and the USL actively promotes it. The combination of venue ownership, development rights, and commercial integration creates differentiated value creation relative to entry price, while simultaneously providing stability that helps owners and the league achieve long term success.

For Institutional Capital: Stadium ownership and mixed-use development participation are a strategic hedge against promotion and relegation dynamics. While competitive performance drives excitement, fan interest, and media coverage (all positive forces that enhance franchise value), investors must always consider the inherent uncertainty of merit-based systems. By anchoring investments in hard assets and diversified real estate revenue, sophisticated investors can participate in the upside of promotion while mitigating the downside of relegation.

3. Regulatory Positioning and Promotion/Relegation

The USL's push toward Tier 1 status and promotion/relegation creates structural optionality unavailable in traditional American sports leagues.

Traditional North American Model | USL Promotion/Relegation Model |

Closed league, expansion-driven growth | Merit-based ascension through competitive performance |

High franchise fees required for league entry (MLS: $500M+) | More approachable entry points with lower-tier franchise fees (League Two: sub $1M, League One: ~$5M, Championship: ~$20M-$40M) and a path to promotion through performance |

Limited exit liquidity | Promotion creates potential valuation changes |

Media revenue distributed equally regardless of performance | Performance directly impacts commercial opportunity |

Understanding Promotion and Relegation as an Investment Variable:

Promotion and relegation systems drive excitement, fan interest, and media coverage. Every match carries stakes, every season has consequences, and the competitive intensity creates emotional engagement that translates into higher attendance, stronger sponsorship, and deeper fan loyalty.

But for investors, this structure introduces a fundamental element of risk that must always be considered when investing in leagues and countries that have integrated promotion and relegation into their systems. Unlike closed leagues, where franchise values are protected by league structure, merit-based systems mean that competitive performance directly impacts economics.

For the USL, this creates both opportunity and discipline:

Promotion Upside: A club that earns promotion gains access to better talent, expanded commercial opportunities, and significant value re-rating

Relegation Considerations: Performance impacts enterprise value, requiring operational discipline and strategic planning

Underwriting Logic: Investors can underwrite opportunities based on operational execution, real estate fundamentals, and market dynamics, reducing reliance on league guaranteed stability

This is where stadium ownership and mixed-use development become essential. By anchoring value in hard assets and diversified revenue streams, investors can participate in the upside of a dynamic, merit-based system while hedging against the inherent uncertainty of competitive outcomes.

(Any investment opportunity discussed herein would be offered only through formal offering documents and subject to investor qualification.)

USL Market Opportunity: Geographic Arbitrage in Underserved Markets

USL, Detroit City FC AlumniFi Field

The USL's geographic strategy targets markets that are either underserved by professional sports or have favorable demographic and economic conditions for soccer-specific growth.

Examples of Strategic Market Positioning:

Detroit City FC

Detroit is the largest metropolitan area in the U.S. without an MLS team, creating an opportunity for a professionally operated USL club to capture a dedicated fanbase. The club has plans for a new 15,000-capacity stadium with mixed-use development, demonstrating how second-tier markets can support sophisticated infrastructure investment.

New Mexico United

Operating in Albuquerque, New Mexico United has rapidly become one of the USL Championship's attendance leaders, averaging over 9,000 fans per match. Momentous Sports Co-Founder Kyle Israel noted, “I have been there to experience a match myself, and was blown away by the experience.” The club benefits from limited professional sports competition and is working through plans for a new stadium development.

Charleston Battery

One of the oldest continuously operating soccer clubs in the U.S., Charleston Battery operates in a high-growth, affluent market with limited professional sports competition. The club plays at Patriots Point, which offers waterfront views and strong community integration. The team has outgrown its current venue. Similar to other clubs, the current ownership is considering future stadium development plans, unlocking multiple revenue streams that simply don’t exist at Patriots Point.

Colorado Springs Switchbacks FC

The Switchbacks opened the $40 million Weidner Field in downtown Colorado Springs in 2021, demonstrating how mid-market clubs can build soccer-specific venues with mixed-use integration. The stadium anchors a broader downtown revitalization effort.

Why This Matters Now: Valuation Re-Rating Across All Levels

The Atlanta NWSL expansion franchise sold for over $160 million in 2025, a record that reflects how quickly soccer valuations are re-rating across all levels.

Women's soccer in particular is seeing explosive growth, with the National Women's Soccer League allowing majority institutional ownership and attracting capital from traditional sports investors and crossover buyers alike. Angel City FC raised capital at a $250 million valuation in 2024: the most expensive takeover in the history of women’s professional sports, demonstrating investor appetite for women's professional soccer.

Backed by Gainbridge, a financial technology company, the Super League features nine clubs with a unique ownership structure that allows for institutional investment at the league and club level. The growing league operates under the U.S. Soccer Division One standards, positioning it as a future competitor to the NWSL for talent, media attention, and sponsor dollars.

Sporting JAX

Sporting JAX, a Momentous Sports portfolio company, is executing a fully integrated club model with both its women’s team, now entering the second half of its inaugural season, and its men’s team, set to debut in the USL Championship this spring. With shared stadium infrastructure and unified operations, Sporting JAX exemplifies a structure we expect to see replicated more broadly across the league. This structure not only enhances asset efficiency through optimized venue utilization and shared front office management but also aligns with evolving dynamics in media rights packaging, sponsorship integration, and fan engagement.

While the NWSL remains the established market leader, the Super League's emergence creates competitive dynamics that should benefit the broader women's soccer ecosystem by driving investment, media coverage, and player development infrastructure. For investors, it offers a risk-adjusted entry point into a high-growth vertical with structural tailwinds that mirror the broader soccer investment thesis.

The Broader Trend Is Clear

Soccer, as a vertical within the sports investment landscape, offers something no other segment can match:

Global Scale: Deep liquidity and diversification are unavailable in closed leagues

Demographic Tailwinds: Compounding growth driven by youth participation, cultural adoption, and catalytic events like the 2026 World Cup and LA28 Olympics

Real Estate Integration: Year-round entertainment platforms with adjacent commercial opportunity that provide downside protection and upside optionality

Competitive Structures: Systems that reward operational sophistication and performance while creating continuous fan engagement

The USL represents the most accessible entry point into this thesis, offering investors exposure to professionalized soccer in growing secondary markets with favorable economics, structural upside, and a league-level commitment to stadium and mixed-use development as the foundation for long term stability and success.

Investment Implications

As the 2026 World Cup approaches and MLS continues to expand, capital will flow down the pyramid into leagues, clubs, and infrastructure that serve the growing American soccer ecosystem.

The question isn't whether soccer is investable. It's whether investors understand the structural dynamics that make it one of the most compelling long-term plays within the sports vertical.

Soccer isn't coming to America. It's already here.

This newsletter is for informational and educational purposes only and does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy any securities. All financial data presented represents historical performance of specific venues and should not be construed as indicative of future results. Past performance does not guarantee future results. Investment in sports venues and related assets involves significant risk, including potential loss of principal. The behavioral economics concepts discussed are based on academic research and historical case studies that may not apply to all situations or guarantee similar outcomes. No representation is made that any investment approach discussed herein will or is likely to achieve results similar to those shown. Any investment decision should be made only after careful consideration of all relevant factors and consultation with qualified financial, tax, and legal advisors. Momentous Sports and Magnolia Hill Partners make no representations or warranties regarding the accuracy or completeness of this information and disclaim any liability arising from your use of this information. This material has not been prepared in accordance with requirements designed to ensure unbiased reporting, and there are no restrictions on trading in the securities discussed herein prior to publication. For qualified accredited investors interested in learning more about our educational materials and investment approach, please contact us directly for a confidential discussion.