The Opportunity Hiding in Plain Sight

Here's what's happening in sports investment right now: Most money is flowing into one of two buckets. Either you're buying a minority stake in a franchise, or you're developing real estate around a team you don’t control.

But almost nobody is doing both at the same time—owning the team AND building out the real estate around it. And that's the interesting part.

When you control both sides, something powerful can happen:

The team drives foot traffic naturally—fans, sponsors, and media attention all converge in one place.

You capture the value that traffic creates through retail, residential, hospitality, and parking.

Each side makes the other more valuable; better real estate improves the fan experience, and team success drives real estate demand.

The Atlanta Braves offer a useful illustration of this concept:

10.3 million people visit The Battery every year

Team revenue more than doubled from $262M in 2016 (their last year renting Turner Field) to $641M in 2023

Why This Strategy Actually Works

Multiple Cash Flow Streams vs. Single-Asset Bets

“Traditional” sports deals isolate returns:

Minority team stake: You might receive shared league revenue and hope for singular franchise appreciation, but rarely have any control as a minority investor

Stadium naming rights: One contract, zero operational control

Adjacent development: Traffic from a team someone else owns, and you're subject to their lease terms, game schedule, etc.

But when you own both the team and the real estate, you may be positioned to participate across multiple cash flow sources, including:

From Team Operations:

Tickets, sponsorships, broadcast rights

Merchandise and concessions

Premium seating (100% yours, not league-shared)

Non-game events

From Real Estate:

Residential rental income

Retail and restaurant leases

Hotel and entertainment revenue

Office space

Parking operations

Advantageous tax structures through real estate investments

The Dual Investment Advantage

Traditional PE funds have a problem placing capital into both the team and the real estate: They are constrained by siloed investment philosophies and restrictions on capital between departments.

Family office capital works differently. You can:

Selectively and flexibly place capital in both the PE and real estate buckets in one investment decision

Develop in phases and recycle capital

Structure deals creatively beyond conventional terms

Wait for optimal exit windows

Focus on secondary markets where there's less competition

Why Now? The Market Timing

Several macro trends are converging:

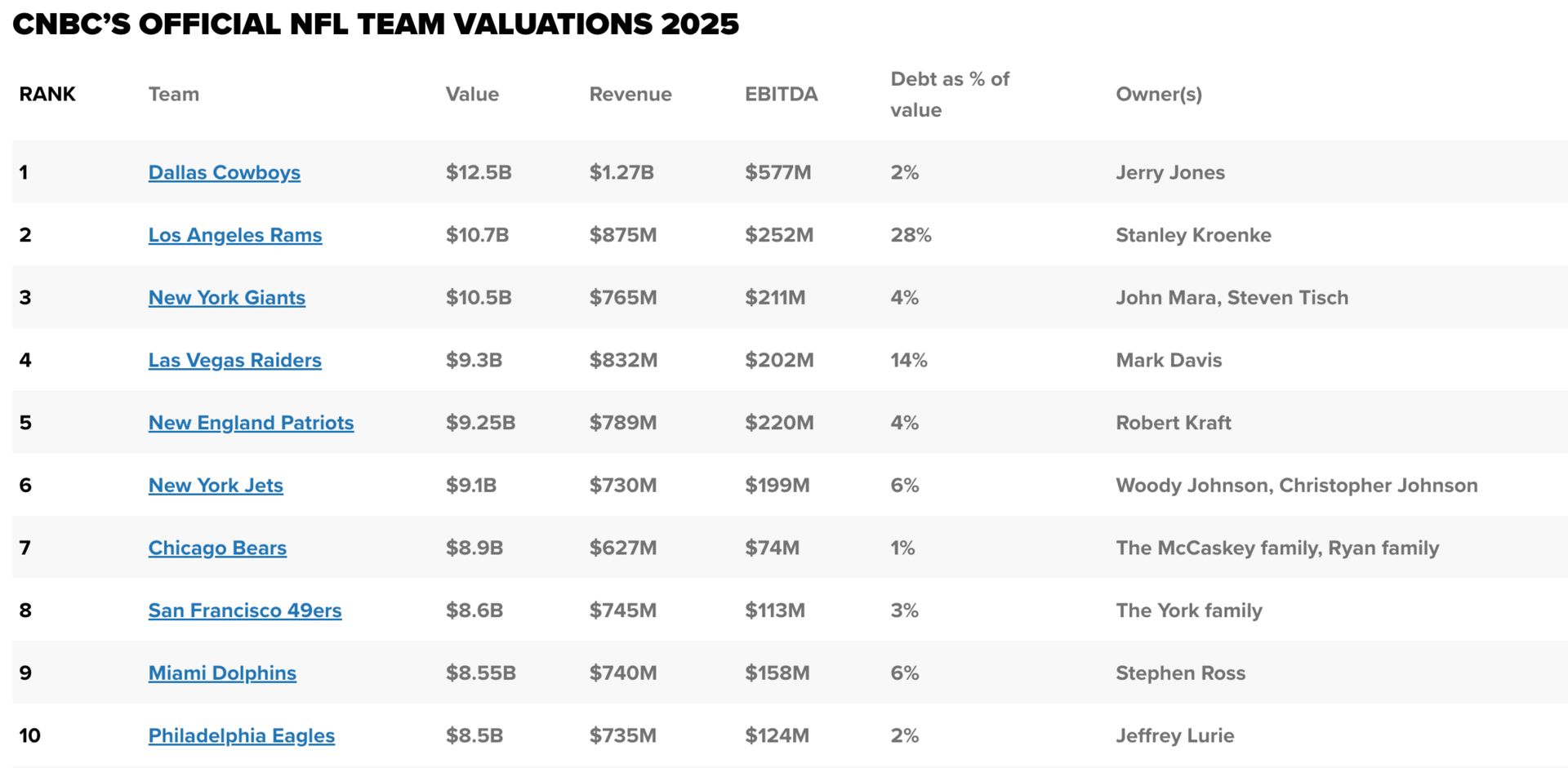

Sports valuations at record highs - Average NFL team: $7.65B, up 18% year-over-year

Secondary markets are growing - Sun Belt migration accelerating

Mixed-use premiums proven - Live-work-play developments commanding 2-3x EBITDA multiples vs. single-use

Private equity barriers falling - NFL now allows PE ownership; other leagues following

Municipal appetite - Cities want catalytic community-based projects post-COVID

The gap: integrated team + real estate from day one.

Case Study: How This Deploys in Real Life

Momentous Sports & The Jacksonville Model

Momentous Sports, backed by Magnolia Hill Partners, illustrates how this strategy can be implemented in practice. We are raising $100 million to invest across team operations and sports-anchored mixed-use real estate projects.

The Team:

Pro Football Hall of Famer John Elway said it best: "Owning a team is great. Owning the land under it? Even better."

Other partners include Tim Tebow, Blake Bortles, Chick-fil-A CEO Andrew Cathy (through his Four Stones real estate firm), and former Robinhood President Scott Friedman. These aren't celebrity endorsers—they are investors in the fund and actively involved.

The Project: Sporting JAX

Sporting Club Jacksonville launched in 2022 with men's and women's professional soccer teams plus a youth academy serving 12,000+ kids.

Early traction looks solid:

6,000+ season tickets sold before their inaugural season. The most by any team in the league.

Major healthcare sponsor (Ascension St. Vincent's) signed

The Real Estate Play:

Momentous is leading development of a mixed-use district around a planned 15,000-seat stadium (opening 2026-2027):

Housing

Retail and restaurants

Hospitality

Public spaces

The Revenue Model:

This creates multiple cash flow layers:

Team operations (tickets, sponsorships, broadcast rights)

Stadium events (concerts, community gatherings)

Youth academy fees (12,000+ recurring players)

Residential leases

Commercial retail tenants

Hotel and restaurant operations

Parking revenue

The Blueprint:

Momentous is not stopping in Jacksonville; we are pursuing similar models in other secondary markets—across the U.S., Latin America, and Europe. Momentous is in talks with groups involved in recent MLB and NBA transactions.

Why Secondary Markets Matter

Momentous targets "thriving communities with strong fan passion but underdeveloped sports infrastructure." Translation: places where the demand exists but the supply hasn't caught up yet.

The arbitrage here:

Lower team acquisition costs vs. major leagues

Cities eager for catalytic projects

Less institutional competition

Easier to authentically integrate with community

Multiple expansion paths (league promotions, franchise appreciation, real estate exits)

Why Qualified Investors Should Care

For accredited investors looking at sports:

Structural advantages:

Multiple value streams vs. single-asset bets

Inflation protection through commercial leases with escalators

Community goodwill creates regulatory moat

Hard asset backing (land, stadium, buildings) plus franchise equity

Access:

Lower minimums than traditional sports PE funds

Direct relationships with operating partners who have credibility and networks

"It allows access to people who previously didn't have it"

Diversification:

Low correlation to traditional stocks and bonds

Sports exposure without single-team risk

Real estate upside with sports attendance downside protection

In Short

The question isn't whether this model works—The Battery Atlanta already answered that. The question is whether investors can replicate it at scale in markets where competition is lower and valuations are more attractive.

That's the behavioral arbitrage. Most capital is still flowing into either major league minority stakes OR standalone real estate projects. Very few are pairing both from inception.

Momentous represents one clear example of how sophisticated investors can deploy against this thesis. Jacksonville serves as an early illustration, with additional opportunities under evaluation in comparable secondary markets.

Learn More:

This newsletter is for informational and educational purposes only and does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy any securities. All financial data presented represents historical performance of specific venues and should not be construed as indicative of future results. Past performance does not guarantee future results. Investment in sports venues and related assets involves significant risk, including potential loss of principal. The behavioral economics concepts discussed are based on academic research and historical case studies that may not apply to all situations or guarantee similar outcomes. No representation is made that any investment approach discussed herein will or is likely to achieve results similar to those shown. Any investment decision should be made only after careful consideration of all relevant factors and consultation with qualified financial, tax, and legal advisors. Momentous Sports and Magnolia Hill Partners make no representations or warranties regarding the accuracy or completeness of this information and disclaim any liability arising from your use of this information. This material has not been prepared in accordance with requirements designed to ensure unbiased reporting, and there are no restrictions on trading in the securities discussed herein prior to publication. For qualified accredited investors interested in learning more about our educational materials and investment approach, please contact us directly for a confidential discussion.