Multi-Club Ownership Meets Moving Crypto Market

Brera Holdings PLC (NASDAQ: BREA) will rebrand as Solmate, a Solana-based digital asset treasury and crypto infrastructure company, after closing an oversubscribed $300M PIPE. Backers include UAE-based Pulsar Group and ARK Invest.

Portfolio: Italian teams, the FENIX Cup, plus clubs in North Macedonia, Mozambique, and Mongolia

Strategy: Use crypto infrastructure to enhance Infrastructure moat

The decision to build infrastructure (validators, servers) rather than merely hold tokens suggests an attempt to differentiate versus passive treasuries (which just accumulate crypto). If they can maintain uptime, validator performance, and low costs, it becomes harder to replicate (Blockworks).Geographic / regulatory arbitrage & UAE positioning

Aligning with UAE’s ambition to be a blockchain hub could bring favorable policy, institutional partnerships, and capital flows. The infrastructure in Abu Dhabi serves as a regional anchor (GlobeNewswire).Multi-club sports as optional upside / diversification

The sports holdings provide an alternate line of business. In a scenario where crypto faces headwinds, the sports side may offer more stability or optionality in global markets (Financial Times).Investor signaling & momentum effects

Backing from ARK Invest, Solana Foundation, and large UAE capital gives credibility, and in the near term, the stock saw dramatic gains (e.g. +225% on announcement) as markets reacted (Investors.com).

Key Takeaway: This represents a novel hedge strategy—a global small-cap sports owner repositioning as crypto infrastructure with sports assets as downside protection. Success means capturing dual upside from Solana's ecosystem growth and sports portfolio appreciation.

CAPITAL MARKETS

Family Offices Continue to Make Their Presence Known

Scale & scope: Family offices now manage trillions globally (often cited in the $5–6 trillion range). A growing share—some estimates ~25%—are already invested in “sports assets,” and another tranche (~25%) are actively evaluating entry. In short: many family offices are transitioning from passive to active in the sports / entertainment space.

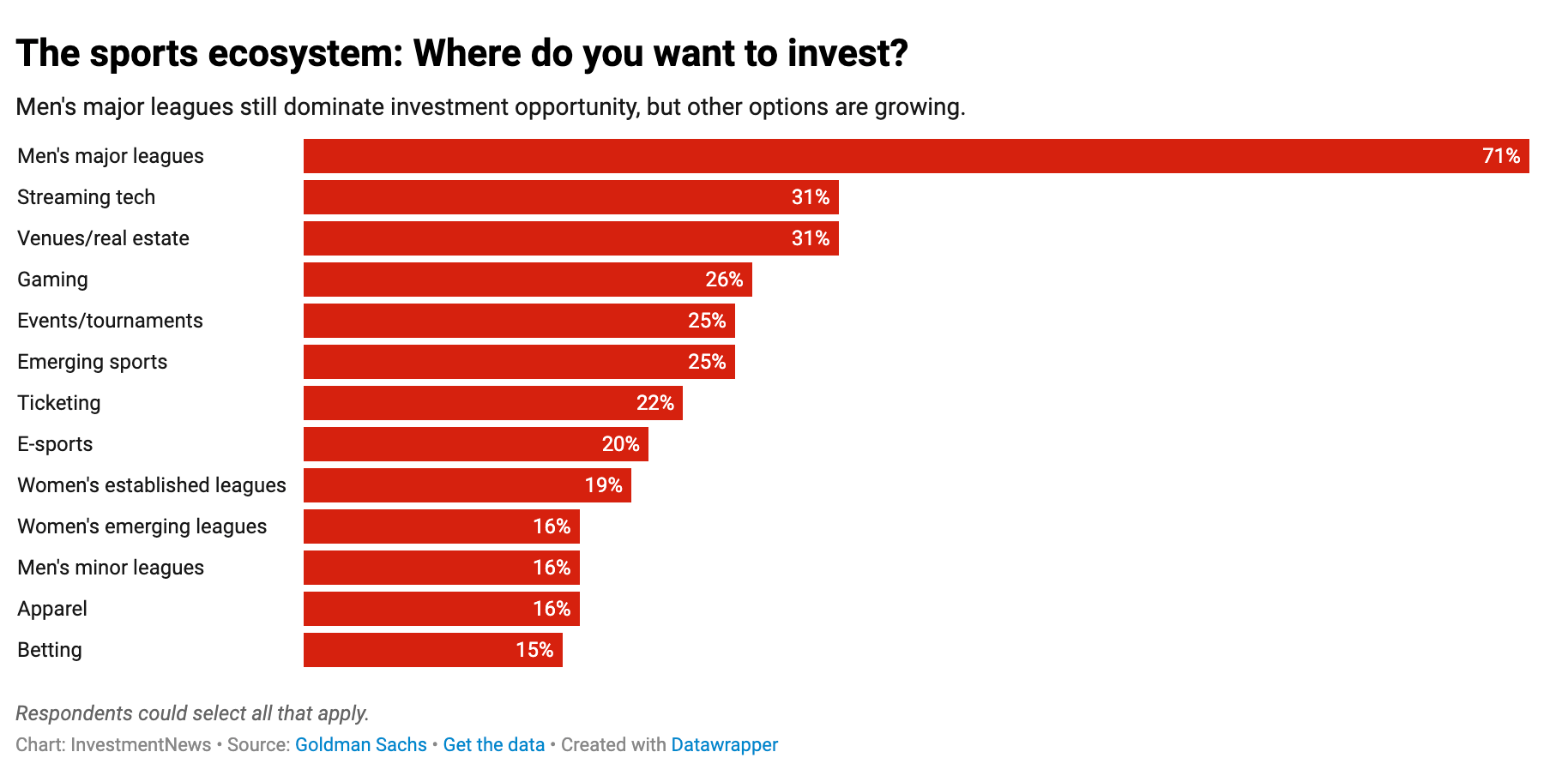

Investment focus & imbalances: Among those family offices investing in sports – ~71% direct toward men’s leagues, ~19% toward women’s leagues, leaving a substantial growth gap in women’s and mixed/gender-agnostic offerings.

This is echoed in broader market analyses: women’s sports currently generate a small share (less than 2 % of U.S. sports market revenues), despite rising fan engagement, media attention, and commercial tailwinds.

Notable deals & names

Julia Koch & Giants minority stake: The Koch family is reported to acquire ~10% of the New York Giants in a deal valuing the franchise at ~$10 billion.

NE Patriots minority stake: Robert Kraft agreed to sell 8% of the Patriots at a $9 billion valuation, with 3% going to private equity firm Sixth Street Partners and 5% to billionaire investor Dean Metropoulos Patriots agree to sell minority stake of team at a $9 billion valuation - NBC Sports. This marks the first time Kraft has sold any portion since acquiring the team for $172 million in 1994 Robert Kraft agrees to sell New England Patriots minority stake in deal that values team at $9B. Sixth Street manages over $100 billion in assets and has pushed hard into sports, with stakes in Real Madrid, FC Barcelona, San Antonio Spurs, and the Boston Celtics NFL's New England Patriots Selling 8% Stake at $9+ Billion Valuation.

49ers $8.6B valuation milestone: San Francisco 49ers agree to sell 3.2% minority stake to Pete Briger Jr. of Fortress Investment Group, valuing franchise at $8.6 billion and generating $272 million while York family retains 88% ownership. Deal requires NFL owner approval but continues record-breaking trend of institutional capital flowing into NFL assets.

Part of broader NFL investment wave: Patriots selling 8% at $9B valuation to Sixth Street Partners and Dean Metropoulos, Giants moving 10% stake to Julia Koch at $10.3B valuation, and Bears completing 2.35% transaction at $8.9B valuation. Investment activity reflects NFL's explosive franchise value growth and 2024 rule changes allowing private equity participation, creating new behavioral arbitrage opportunities for family offices targeting sports infrastructure assets.

Strategic shift in approach

The trend is moving away from trophy mindset (i.e. owning prestige franchises as legacy assets) toward structured, diversified “alternatives” investing: minorities, stakes in media/sponsorship/licensing, facility assets, league-level investments, vertical integration, real estate adjacent to stadiums, etc.

SPORTS REAL ESTATE

Infrastructure Investment Drives Two Major Facility Projects

Women's Sports Makes Statement with Record Training Facility: The LA Sparks announced a groundbreaking $150 million investment in a state-of-the-art practice facility in El Segundo, representing the largest single-team investment in women's sports history. The 55,000-square-foot facility, scheduled to open in 2027, features the WNBA's first-ever indoor-outdoor player sanctuary with outdoor spa pool, dedicated nap rooms, hydrotherapy suites, and panoramic ocean views.

Designed by Gensler with interiors by Studio Blitz (a women-run design firm), the facility includes two WNBA regulation courts, a circular locker room designed to foster team unity, and extensive natural light through retractable doors. The project reinforces the broader trend of premium facility investments targeting performance optimization and athlete wellness, setting new infrastructure standards for women's professional sports.

Miami FC Anchors $300M Multi-Use Development: Miami FC will relocate to a new 15,000-seat stadium as part of Sports Performance Hub's 80-acre, $300 million development project in Homestead. The comprehensive complex includes a professional training academy, youth boarding school, public sports and recreation facilities, a sports-themed hotel, and baseball fields, basketball and tennis courts.

The project operates under an 80-year ground lease with the City of Homestead and is structured at no cost to taxpayers. Co-owner Riccardo Silva, also a Sports Performance Hub shareholder, positions this as part of broader USL Championship expansion, joining similar stadium projects in Pittsburgh, Detroit, and Sacramento. The facility will also host the Homestead Championship Rodeo, demonstrating the multi-event revenue model driving modern sports venue development.

Investment Thesis: Both projects highlight the evolution toward holistic sports complexes that blend performance facilities with community programming, hospitality, and mixed-use development—creating diversified revenue streams beyond traditional game-day economics.

LABOR MARKETS

WNBA Labor Battles

The WNBPA has opted out of the current CBA ahead of its expiration (Oct 31), signaling readiness for structural change.

Players are pushing hard for revenue-sharing reforms in light the new 11-year, $2.2B media deal, pointing to surging media valuations and expanding league exposure. Political voices and advocates are increasingly framing this as a broader equity issue (gender, pay, growth) — making the WNBA an increasingly visible labor test case.

IN CASE YOU MISSED IT

International Expansion: Multi-club ownership models offer 4–16x valuation multiples via promotion strategies.

Crypto-Sports Infrastructure: Solmate's UAE base highlights regulatory arbitrage opportunities.

Private Equity Liquidity: Minority stake premiums are collapsing as institutional capital floods in.

NFL Team Valuations: Most sources place the average team value in 2025 at $7.1 billion, up ~25% YoY. (Bleacher Report / Forbes). A recent high-profile transaction (e.g. Chicago Bears minority sale) valued the franchise at $8.9 billion. (Sports Business Journal). The Bears’ sale of a 2.35% stake to existing owners, approved by the NFL, reset the league record for a minority stake deal. (Sports Business Journal)

Sources: GlobeNewswire, CNBC Sports Business, Goldman Sachs, ESPN, Bloomberg, Sportico, and other financial news sources as hyperlinked.

This newsletter is for informational and educational purposes only and does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy any securities. All financial data presented represents historical performance of specific venues and should not be construed as indicative of future results. Past performance does not guarantee future results.

Investment in sports venues and related assets involves significant risk, including potential loss of principal. The behavioral economics concepts discussed are based on academic research and historical case studies that may not apply to all situations or guarantee similar outcomes. No representation is made that any investment approach discussed herein will or is likely to achieve results similar to those shown.

Any investment decision should be made only after careful consideration of all relevant factors and consultation with qualified financial, tax, and legal advisors. Momentous Sports and Magnolia Hill Partners make no representations or warranties regarding the accuracy or completeness of this information and disclaim any liability arising from your use of this information.

This material has not been prepared in accordance with requirements designed to ensure unbiased reporting, and there are no restrictions on trading in the securities discussed herein prior to publication.

For qualified accredited investors interested in learning more about our educational materials and investment approach, please contact us directly for a confidential discussion.