Episode 5 of the Momentous Sports podcast is live.

This week, we sat down with Dom Bullard, founder of Athletiverse, to talk about one of the biggest gaps in sports today:

Teams produce a ton of content — but very few know how to measure it, price it, or use it to drive revenue.

Dom walks through how Athletiverse helps teams, leagues, and athletes turn audience attention into commercial value by focusing on three core areas:

1. AI-Guided Content Decisions

Instead of guessing what to post, AI helps identify what fans actually care about — and when they care about it.

2. Earned Media Value (EMV)

Most social posts benefit partners (logos, jerseys, brand mentions). EMV helps teams put a dollar amount on that value — which matters in sponsorship conversations.

3. Better Fan Touchpoints

Whether it’s a QR moment in-stadium or how content is distributed online, the goal is to create connection, not just views.Why This Matters to Momentous

This is directly aligned with how we operate:

We believe sports teams are media companies with live event distribution.

Stronger fan engagement leads to stronger partnership revenue.

Our OpCo + PropCo strategy works best when the fan relationship is strong and measurable.

This episode helps explain how that relationship is built.Key Idea: Content isn’t the product.

The fan relationship is the product.

And the better we understand and measure that relationship, the more value we can unlock — for clubs, partners, and communities.

Watch here:

And listen on Spotify here:

What This Podcast Is About

We explore sports as an asset class—where teams (OpCo) and real estate (PropCo) compound into durable enterprise value.

Each episode brings operators, investors, and owners into the room to unpack how deals are sourced, financed, entitled, built, and activated—plus the partnerships and community outcomes that are impacting the market most.

THIS WEEK'S TOP STORY

Lululemon Athletica Enters Licensed NFL Apparel Market, Signals Growth in Fan-Lifestyle Segment

On October 27, 2025, Lululemon announced a groundbreaking apparel deal with the National Football League (NFL) to launch an officially licensed collection covering all 32 teams. Barron's

Deal structure & implications:

The collection will include men's and women's apparel and accessories, leveraging Lululemon's core lines (such as the Steady State for men and Define, Scuba, Align lines for women). Barron's

The merchandise will be available via the NFL site, Fanatics, and in-stadium retail locations. Barron's

This marks Lululemon's first foray into officially licensed pro-sports apparel at this scale. Barron's

Strategic context: The deal reflects the convergence of athletic-lifestyle brands and major pro-sports franchises: teams are increasingly monetizing fan lifestyle, not just game-day gear. For the NFL, working with a premium lifestyle brand raises the potential for elevated fan apparel pricing, broader demographic reach (especially among female shoppers), and higher margin merchandise.

Why it matters: From a capital-markets perspective, the move signals that pro-sports licensing is evolving: not just basic fan tees but premium lifestyle collaborations with crossover brands. For brand management and digital marketing teams, the partnership highlights fan-engagement and commerce strategies that merge performance fashion, fandom and omnichannel retail.

Market observation: This deal illustrates how pro-sports leagues and franchises are leveraging ancillary revenue sources (merchandise, lifestyle licensing) to broaden their monetization beyond media rights and ticketing. The collaboration with Lululemon demonstrates how fan-apparel is evolving toward brand-ecosystem partnerships, which has historically resulted in higher average order values, premium product lines, and expanded global reach in similar market segments.

SPORTS REAL ESTATE

Los Angeles Dodgers Marathon on Diamond Underscores Value of Venue & Fan Experience

On October 26, the Dodgers and the Toronto Blue Jays locked in an 18-inning battle in the 2025 MLB World Series Game 3 — one of the longest games in World Series history. EverythingGP

Why it matters: Extended games like this amplify in-stadium revenue (concessions, parking, merchandising) and enhance broadcast value (more storylines, higher viewer retention). For stadium/arena owners, such marquee events reinforce the proposition: owning the venue provides more control over revenue streams tied to fan-experience and event duration, not just the tenancy contract.

Market observation: In high-stakes games that go deep into overtime/extra innings, the incremental revenue and brand exposure have historically been significant. For franchise owners with arena control, such events have validated investment in premium facilities, mixed-use development (retail/hospitality adjacent to the venue) and experience enhancements.

CAPITAL MARKETS

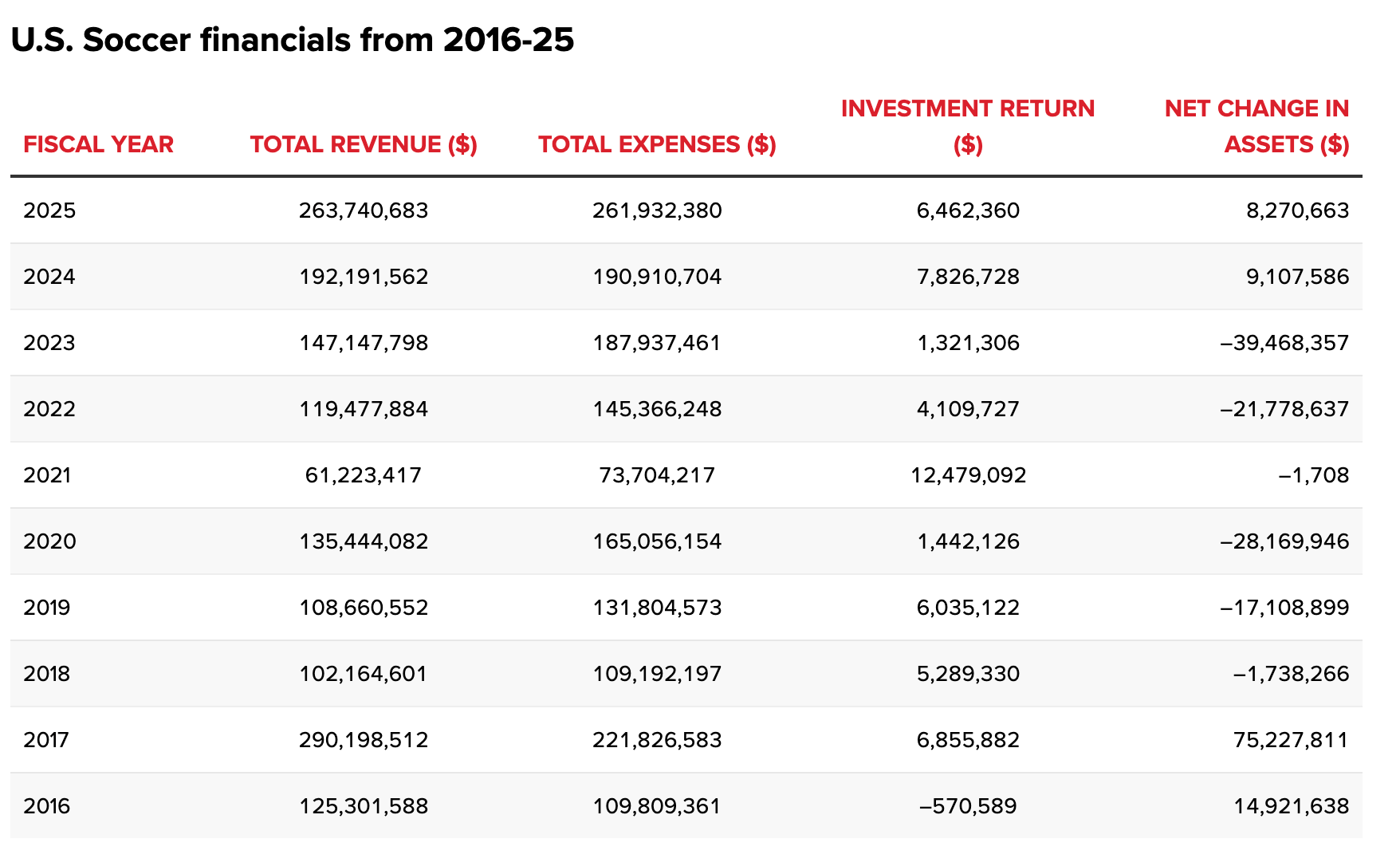

U.S. Soccer Federation Reports Record Revenue—Institutional Capital Eyes Sports Platforms

In the latest annual disclosure, U.S. Soccer generated $263.7 million in revenue for fiscal 2025 — a 37% increase from 2024 and the highest level since 2017. Sports Business Journal

Why it matters: For investors and rights-buyers, this signals that even "non-major" leagues can scale up notable revenue growth, potentially reducing perceived risk in sports investing. As institutional capital flows into sports (franchises, leagues, media platforms, real-estate), such metrics feed into underwriting models and valuations.

Market observation: One trend emerging: sports properties are being treated more like growth companies or infrastructure platforms rather than pure entertainment. With stable rights deals, sponsorships expanding, and digital monetization increasing, institutional investors may assess capital structure (debt vs equity), return horizons (10-15 years) and exit pathways (e.g., secondary stakes, asset portfolios).

LABOR MARKETS

Big Ten Conference's Private Capital Deal in Holding Pattern

The Big Ten's proposed multi-billion-dollar deal to spin off media and sponsorship rights via a private-capital vehicle remains stalled amid governance and approval hurdles. ESPN

Key findings: The deal would have extended "grant of rights" through 2046 and could funnel billions into member campuses. ESPN Some member institutions remain skeptical — raising governance, valuation and long-term control issues.

Why it matters: As collegiate athletics undergoes structural change (e.g., NIL, revenue-sharing, transfer portal), the capital markets view of these leagues is shifting. The deals introduce external private capital into what was previously school-governed territory.

Market observation: A key question: Which leagues or associations will successfully integrate private capital while preserving governance and stakeholder alignment? The Big Ten deal illustrates both the potential upside and complexity of monetizing rights in governance-rich ecosystems.

IN CASE YOU MISSED IT

Record-setting playoff start: Vancouver Whitecaps FC opened the MLS Cup Playoffs with a dominant 3-0 win over FC Dallas on Oct 26, taking a 1-0 series lead. ESPN

Broadcaster's event calendar in full swing: A major roundup of sports events in the Bay Area on Oct 26–27 shows how dense the live-sports schedule remains — NFL, NBA, NHL, MLS, F1 and more. San Francisco Chronicle

Streaming & rights implication: With networks like Fox expanding live-sports coverage, streaming platforms and rights-buyers face greater competition and upward pressure on valuations.

Upcoming watch-points: Franchise valuations in major sports leagues continue climbing; venue ownership and mixed-use developments remain structural drivers of long-term value; collegiate sports rights deals will hinge on governance frameworks and stakeholder alignment.

SOURCES:

The Guardian - WSL Debt Financing: https://www.theguardian.com/football/2025/oct/17/wsl-considers-borrowing-tens-of-millions-to-accelerate-growth-plans

Sportico - NBA Valuations 2025: https://www.sportico.com/valuations/teams/2025/nba-team-values-2025-warriors-lakers-knicks-1234873773/

ESPN - Celtics Sale Approval: https://www.espn.com/nba/story/_/id/45969002/nba-approves-celtics-sale-record-61-billion-valuation

Las Vegas Sun - WNBA CBA Negotiations: https://lasvegassun.com/news/2025/oct/05/wnba-finals-overshadowed-by-labor-dispute-as-locko/

Tucson - WNBA Revenue Data: https://tucson.com/sports/professional/nba/article_94d8abc6-751a-449c-86da-97caf17aae2c.html

University Business - NCAA NIL Concerns: https://universitybusiness.com/insider-study-reveals-massive-concern-over-college-athletics/

College Athlete Compensation - House Settlement: https://www.collegeathletecompensation.com/

This newsletter is for informational and educational purposes only and does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy any securities. All financial data presented represents historical performance of specific venues and should not be construed as indicative of future results. Past performance does not guarantee future results. Investment in sports venues and related assets involves significant risk, including potential loss of principal. The behavioral economics concepts discussed are based on academic research and historical case studies that may not apply to all situations or guarantee similar outcomes. No representation is made that any investment approach discussed herein will or is likely to achieve results similar to those shown. Any investment decision should be made only after careful consideration of all relevant factors and consultation with qualified financial, tax, and legal advisors. Momentous Sports and Magnolia Hill Partners make no representations or warranties regarding the accuracy or completeness of this information and disclaim any liability arising from your use of this information. This material has not been prepared in accordance with requirements designed to ensure unbiased reporting, and there are no restrictions on trading in the securities discussed herein prior to publication. For qualified accredited investors interested in learning more about our educational materials and investment approach, please contact us directly for a confidential discussion.