THIS WEEK'S TOP STORY

Women's Super League Explores Major Debt Financing to Accelerate Competition Growth

On October 17, 2025, The Guardian reported that the Women's Super League (WSL) is considering borrowing tens of millions of pounds to accelerate growth. The WSL board has engaged Goldman Sachs and Deloitte to examine funding options, with debt financing emerging as the preferred path over selling equity stakes.

Deal structure:

Goldman Sachs is handling investment banking while Deloitte provides accounting and advisory services to structure the potential borrowing. The borrowed funds would boost central payments and prize money distributed to WSL clubs, with the goal of triggering a virtuous cycle: better-funded clubs → improved product quality → higher sponsorship and broadcast values → more revenue to service debt and reinvest.

The WSL could secure borrowing against future commercial and broadcast income streams that have grown significantly. A new £65 million five-year TV deal with Sky Sports started this season, alongside improved contracts with title sponsor Barclays and kit supplier Nike — providing contracted revenue to backstop the financing.

Strategic context:

Women's Professional Leagues Limited (rebranded as WSL Football in May 2025) took control of the top two divisions from the FA last year. The newly independent entity received a £20 million interest-free loan from the Premier League in August 2024 to cover startup costs and build a 40-person staff from scratch.

While Goldman Sachs and Deloitte are expected to surface private equity offers to buy stakes in the competition, WSL leadership is pushing back. They appear to be learning from Premiership Rugby's experience selling 27% to CVC Capital Partners six years ago—a deal many in rugby circles believe resulted in short-term gains without lasting infrastructure improvement.

A source told The Guardian: "The WSL is undertaking a financial review, but this is not about selling a stake in the competition. That is highly unlikely. But the league needs to grow, and the clubs need money."

Why it matters:

The preference for debt over equity reflects a sophisticated approach to capital structure. The WSL aims to use leverage to accelerate growth while maintaining control and preserving long-term upside for clubs and the league itself, rather than accepting potentially dilutive private equity capital at current valuations.

Analyst perspective:

This represents a case study in growth-stage capital allocation for emerging sports properties. Rather than selling equity at what could be trough valuations, the WSL is leveraging contracted revenue streams (the Sky deal alone provides £13 million annually) to fund expansion. Higher central distributions can improve competitive balance and player quality, which in turn increases broadcast and sponsorship values — strengthening long-term sustainability.

From an industry-analysis standpoint, the women's sports investment landscape remains in an early but promising phase. The WSL's preference for debt financing suggests confidence in revenue growth and reflects a broader trend toward professionalization within women's sports.

SPORTS REAL ESTATE

Arena Ownership Drives Record NBA Valuations: Warriors' $11.33B Lead Reinforces the Power of Vertical Integration

On October 16, 2025, Sportico released its annual NBA franchise valuations, with the Golden State Warriors once again topping the list at $11.33 billion — a 24% increase from 2024. The average NBA franchise valuation rose 20% year-over-year to $5.51 billion, underscoring how venue ownership and real estate control remain critical levers of long-term enterprise value.

The real estate advantage: The Warriors' ownership of Chase Center and the surrounding Mission Bay district has transformed the team from a basketball franchise into a vertically integrated real estate and entertainment enterprise. The facility generates $833 million in annual revenue, including over $5 million per game in ticket sales, $2.5 million in luxury suite revenue, and substantial non-basketball income from concerts, retail, and events. That diversified revenue stream is what separates the Warriors from tenant-model franchises.

League-wide ripple effect: As the NBA finalizes its $76 billion media rights deal and eyes new expansion markets in Seattle and Las Vegas, full control of venue and mixed-use development rights is becoming a defining differentiator. Recent control transactions — including the Celtics ($6.1B), Lakers ($10B), and Trail Blazers ($4.25B) — all reflect premium pricing tied to infrastructure ownership and redevelopment potential.

Why it matters: This year's valuation surge isn't just about broadcast dollars — it's about real estate as equity. Teams that own their arenas are now being valued like multi-asset operating platforms, not single-sport entities. The Warriors' $11.33 billion figure serves as a case study in how modern sports ownership combines facility control, district development, and experiential revenue streams into a unified value engine.

Analyst takeaway: The NBA's valuation trend reaffirms what developers and investors already know: sports real estate is the multiplier. Control of the venue unlocks diversified revenue, higher margins, and long-term appreciation that pure franchise operations can't replicate.

CAPITAL MARKETS

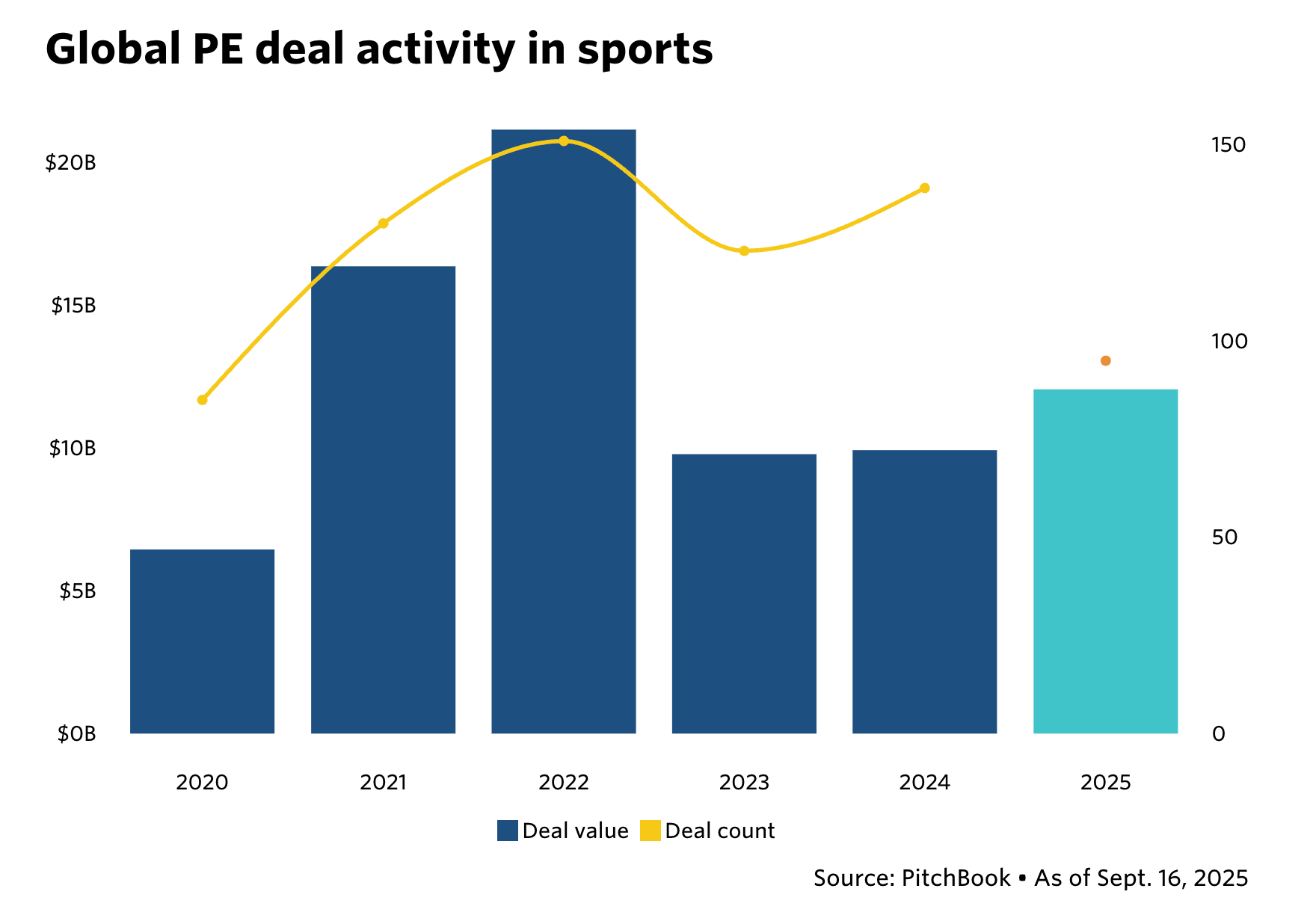

Private Capital Floods Into Sports: Record Institutional Flows Reshape the Investment Landscape

Q3 2025 marked a decisive inflection point for institutional capital entering the sports ecosystem. Across private equity, infrastructure, and family office channels, more than $20 billion in new commitments were announced this quarter alone—representing the most active fundraising period in sports investment history.

Capital flow dynamics: Global asset managers are no longer treating sports as a niche alternative—they're formalizing dedicated strategies spanning franchises, media, technology, and sports-anchored real estate. Multi-billion-dollar vehicles launched in Q3 reflect a new asset-class consensus: sports properties are being underwritten with the same rigor and capital durability once reserved for infrastructure or private credit. Recent examples include CVC Capital Partners' $14 billion Global Sports Group fund, Apollo Global Management's $5 billion sports-focused fund, and Arctos Partners' expanded capital commitments across multiple sports leagues.

Structural shift: This surge underscores a broader reclassification of sports as core long-term capital, not opportunistic exposure. Institutional investors are designing funds with 10–15 year hold periods, diversified across leagues and ancillary developments, signaling confidence in sports as a scalable, inflation-resistant category.

Why it matters: The velocity of capital formation confirms that sports are now investable at institutional scale. For operators and strategic platforms already embedded in the ecosystem, this means both validation and competition: valuations will rise, timelines will extend, and domain expertise will become the differentiator.

Analyst takeaway: The Q3 wave of sports fund launches demonstrates that the market's early-mover phase is ending. As institutional capital floods in, operators with authentic access, operating experience, and control of real assets—not just capital—will define the next cycle of returns.

LABOR MARKETS

NCAA Division I Leaders Express Widespread Concern Over NIL and Revenue Sharing

During the week of October 9, 2025, the Knight Commission and Elon University Poll released survey results revealing significant concern among NCAA Division I leaders: 62% said the mission, finances, and structure of college sports are headed in a "negative direction."

Key findings:

75% believe the $2.8B House v. NCAA settlement will negatively affect their programs.

55% fear NIL and revenue sharing will worsen gender equity in athletics.

Context:

The College Sports Commission (CSC) made headlines this week by launching an anonymous NIL violation tip line on October 9. The CSC reported processing 6,100 NIL deals totaling $35.4M, though administrators continue to cite slow processing and compliance challenges with the Deloitte-developed NIL Go platform.

Why it matters:

Schools will soon be permitted to revenue-share up to $20.5M annually with athletes, transforming college athletics economics. The pessimism captured in the survey underscores the scale of uncertainty surrounding governance, finances, and institutional identity as the House settlement moves toward final approval in spring 2026.

Analyst perspective:

Industry analysts view the transition as part of a broader professionalization trend in college athletics. While administrators express concern, investors and media partners see the evolution toward professionalized structures as a path to clearer monetization frameworks.

IN CASE YOU MISSED IT

Drew Brees and Larry Fitzgerald Advance to Pro Football Hall of Fame Semifinalist Round – Quarterback Drew Brees and wide receiver Larry Fitzgerald, both first-year eligible candidates, were among 52 players selected as semifinalists for the 2026 Pro Football Hall of Fame class. Pro Football Hall of Fame The selection of two first-ballot legends signals continued strong franchise equity in legacy player brands — key for sponsorship, licensing, and sports-memorabilia investors tracking post-career monetization opportunities.

Michael Jordan Joins NBC Sports as Special Contributor for NBA Coverage – Michael Jordan debuted his "MJ: Insights to Excellence" segment during NBC's return to NBA broadcasting on October 21, 2025, stating his goal is "to give back to the game." NBC Sports Jordan's involvement in NBC's 11-year, $76 billion NBA rights deal underscores the premium value of iconic athlete IP in driving viewership and engagement — a critical behavioral signal for sports-media rights and talent-equity investors.

Apple Inc. Secures ~$700M U.S. Streaming Deal for Formula 1 – Apple signed a five-year, approx. $700 million contract to stream F1 races in the U.S., replacing the prior rights holder. Financial Times The deal emphasizes the value of global sports rights and the premium that tech platforms are willing to pay for live engagement — a key indicator for media/rights-monetization investors.

NFL Owners to Vote on Sale of Stake in New York Giants at $10B+ Valuation – On October 22, 2025, NFL owners approved the sale of roughly 10% of the New York Giants franchise at a valuation exceeding $10 billion. This underscores major franchise-equity liquidity events and the private-capital appetite in major-league teams — key behavioral markers for secondary market valuation benchmarks.

Adapti, Inc. Signs LOI to Acquire Levelution Sports (NIL/Athlete Representation Platform) – Adapti inked a letter of intent to acquire Levelution Sports, expanding into NIL and athlete-representation capabilities. Soo Evening News The acquisition highlights the intersection of athlete monetization, platform business models and sports-tech investment — an area with rising investor interest as athlete rights become more institutionalized.

MLB viewership surges to record levels – The Blue Jays' Game 7 clincher drew a record television audience, underscoring that NFL, MLB, college football, US Grand Prix, and other major sports are being watched at historic rates. This viewership momentum reinforces the value thesis for media rights and franchise valuations across leagues.

NBA targets European league launch within 24 months – The league is formalizing plans to establish a European division, creating significant opportunity for arena development, infrastructure investment, and market expansion beyond North America.

Episode 4 of the Momentous Sports podcast is live.

Host Kyle Israel (former UCF QB; Managing Partner) sits down with New Mexico United founder & president Peter Trevisani to unpack how belief becomes infrastructure, building a club around community, not just commerce.

They dig into the USL model, creative storytelling as strategy, stadiums as civic symbols, and why sports, paired with place, are an investable, generational asset.

Watch here:

And listen on Spotify here:

What This Podcast Is About

We explore sports as an asset class—where teams (OpCo) and real estate (PropCo) compound into durable enterprise value.

Each episode brings operators, investors, and owners into the room to unpack how deals are sourced, financed, entitled, built, and activated—plus the partnerships and community outcomes that are impacting the market most.

SOURCES:

The Guardian - WSL Debt Financing: https://www.theguardian.com/football/2025/oct/17/wsl-considers-borrowing-tens-of-millions-to-accelerate-growth-plans

Sportico - NBA Valuations 2025: https://www.sportico.com/valuations/teams/2025/nba-team-values-2025-warriors-lakers-knicks-1234873773/

ESPN - Celtics Sale Approval: https://www.espn.com/nba/story/_/id/45969002/nba-approves-celtics-sale-record-61-billion-valuation

Las Vegas Sun - WNBA CBA Negotiations: https://lasvegassun.com/news/2025/oct/05/wnba-finals-overshadowed-by-labor-dispute-as-locko/

Tucson - WNBA Revenue Data: https://tucson.com/sports/professional/nba/article_94d8abc6-751a-449c-86da-97caf17aae2c.html

University Business - NCAA NIL Concerns: https://universitybusiness.com/insider-study-reveals-massive-concern-over-college-athletics/

College Athlete Compensation - House Settlement: https://www.collegeathletecompensation.com/

This newsletter is for informational and educational purposes only and does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy any securities. All financial data presented represents historical performance of specific venues and should not be construed as indicative of future results. Past performance does not guarantee future results. Investment in sports venues and related assets involves significant risk, including potential loss of principal. The behavioral economics concepts discussed are based on academic research and historical case studies that may not apply to all situations or guarantee similar outcomes. No representation is made that any investment approach discussed herein will or is likely to achieve results similar to those shown. Any investment decision should be made only after careful consideration of all relevant factors and consultation with qualified financial, tax, and legal advisors. Momentous Sports and Magnolia Hill Partners make no representations or warranties regarding the accuracy or completeness of this information and disclaim any liability arising from your use of this information. This material has not been prepared in accordance with requirements designed to ensure unbiased reporting, and there are no restrictions on trading in the securities discussed herein prior to publication. For qualified accredited investors interested in learning more about our educational materials and investment approach, please contact us directly for a confidential discussion.