Industry observers note that the smartest real estate players aren’t just looking at office buildings or warehouses right now—they’re increasingly exploring fields and facilities tied to youth sports.

Reported figures suggest an estimated $52 billion in annual consumer spending, with relatively little institutional-grade infrastructure currently built to capture it. Youth sports reportedly generate nearly double the NFL’s revenue, yet much of this activity still takes place on converted high school fields with temporary bleachers and snack shacks.

Analysts suggest this gap represents an opportunity for developers, municipalities, and hospitality operators to reimagine youth sports as part of a larger hospitality and tourism ecosystem.

Case Study: The Marvella Sports Complex (Newton County, Indiana)

A recent example highlights how this vision is beginning to take shape.

According to public announcements and local reporting, the Marvella Sports Complex is a planned ~$98 million development in Newton County, Indiana, described as the nation’s first dedicated sports and leadership complex for women and girls. Indiana Economic Digest

Reported project details include:

Site & Scale: ~100 acres off Interstate 65 near Fair Oaks Farms, between Chicago and Indianapolis. Indiana Economic Digest+1

Phase One: ~300,000 sq. ft. indoor facility with 14 volleyball courts, 8 basketball courts, and 2 high school regulation soccer fields. Indiana Economic Digest

Phase Two: Six multipurpose outdoor fields, four softball fields, parking, lighting, and food service. Indiana Economic Digest

Funding Mix: Private equity, social impact investments, charitable sources, and public funds—including ~$4.5 million in state READI grants and ~$4 million in tax credits. Indiana Economic Digest

Jobs & Impact: Projected ~1,000 new jobs and significant visitor draw over time. Indiana Economic Digest

Beyond its economic promise, Marvella is also positioned as a purpose-driven development, aiming to promote leadership and equity in sports for women and girls. Indiana Economic Digest+1

Market Intelligence: The Economics of Weekend Sports Travel

Research continues to show the spending power of families engaged in youth sports:

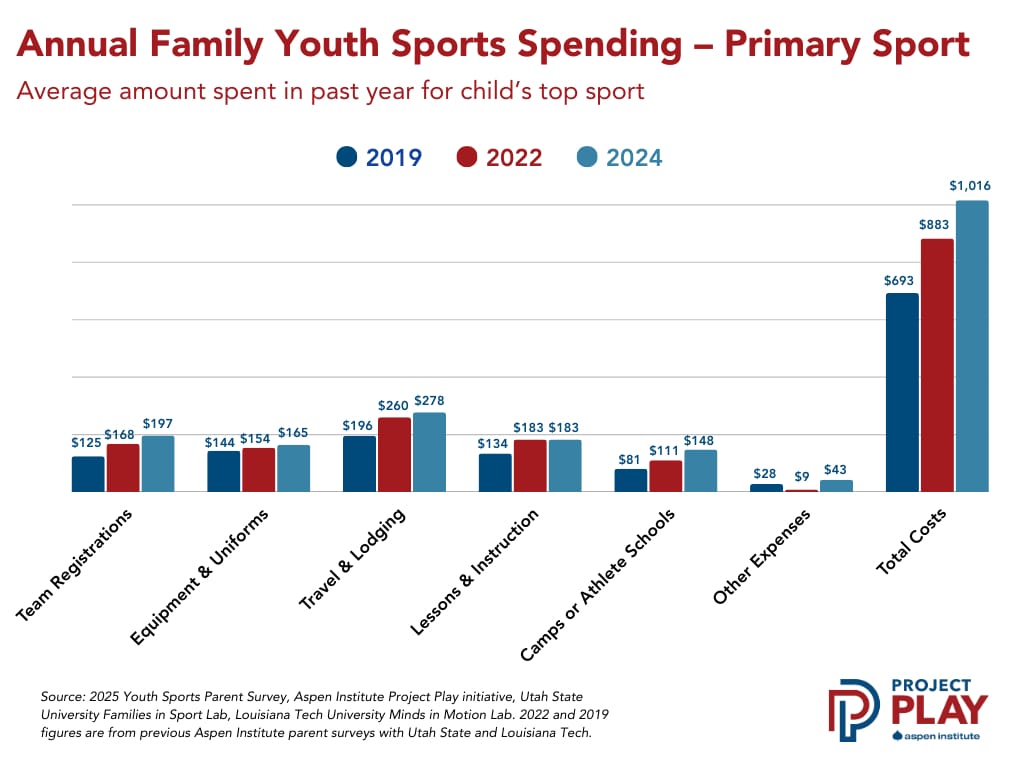

The Aspen Institute’s Project Play survey reports that families spent an average of $1,016 annually on their child’s primary sport in 2024, a 46% increase since 2019. Project Play

Including secondary sports, that figure rises to ~$1,500 per child. Project Play

About $414 of that $1,016 is directed to travel and lodging. Project Play

Scaled across ~27.3 million children in organized sports, this represents an estimated $11.3 billion annually in travel spending. Project Play+1

Approximately 73% of tournament families extend their trips beyond the event itself, spending an average of 1.8 additional days in the destination market. Project Play

These patterns suggest youth sports function not just as local recreation, but as a form of family tourism with hospitality implications.

Economics at Scale: Reported Averages

Analysts have estimated the following illustrative metrics:

Average tournament draws ~450 visiting families

Reported average non-sports spend per family: ~$312

Estimated ~$140,400 in local economic activity per tournament weekend

Facilities hosting 60–80 tournaments annually could generate $8.4–$11.2 million per annum in ancillary activity, before counting corporate events, camps, or local league usage

Why This Matters Now

Industry participants point to several converging factors creating what some describe as a “development window”:

Behavioral shifts: Families prioritize experiential activities, especially post-pandemic.

Public support: Municipal financing tools like TIF districts and sports facility bonds remain accessible.

Hospitality partnerships: Hotel operators and brand partners are seeking alternative real estate formats with predictable weekend demand.

Projects like Marvella show how youth sports facilities can evolve into multi-purpose hospitality ecosystems, blending sports programming with travel, lodging, dining, retail, and leadership programming.

Key Considerations for Stakeholders

Geographic Positioning

Facilities near major metros but outside high-cost cores appear well-positioned. Proximity to highways/airports can be a performance enhancer.Revenue Diversification

Many complexes aim for 40–60% of revenue from non-sports activities (hotels, restaurants, events).Financing Models

Mixed funding—public/private partnerships, tax incentives, impact investing—helps manage risk and unlock support.

Strategic Outlook

Industry analysis suggests youth sports are increasingly being reframed as part of hospitality rather than standalone civic projects. Marvella’s example shows how purpose-driven design, community alignment, and diversified financing can create both social and economic outcomes.

Sources:

$98 million Marvella sports complex for women and girls to break ground in Newton County (Indiana Economic Digest) Indiana Economic Digest

Project Play survey: Family spending on youth sports rises 46 over five years (Aspen Institute / Project Play)

This newsletter is for informational and educational purposes only and does not constitute investment advice, an offer to sell, or a solicitation of an offer to buy any securities. All financial data presented represents historical performance of specific venues and should not be construed as indicative of future results. Past performance does not guarantee future results. Investment in sports venues and related assets involves significant risk, including potential loss of principal. The behavioral economics concepts discussed are based on academic research and historical case studies that may not apply to all situations or guarantee similar outcomes. No representation is made that any investment approach discussed herein will or is likely to achieve results similar to those shown. Any investment decision should be made only after careful consideration of all relevant factors and consultation with qualified financial, tax, and legal advisors. Momentous Sports and Magnolia Hill Partners make no representations or warranties regarding the accuracy or completeness of this information and disclaim any liability arising from your use of this information. This material has not been prepared in accordance with requirements designed to ensure unbiased reporting, and there are no restrictions on trading in the securities discussed herein prior to publication. For qualified accredited investors interested in learning more about our educational materials and investment approach, please contact us directly for a confidential discussion.